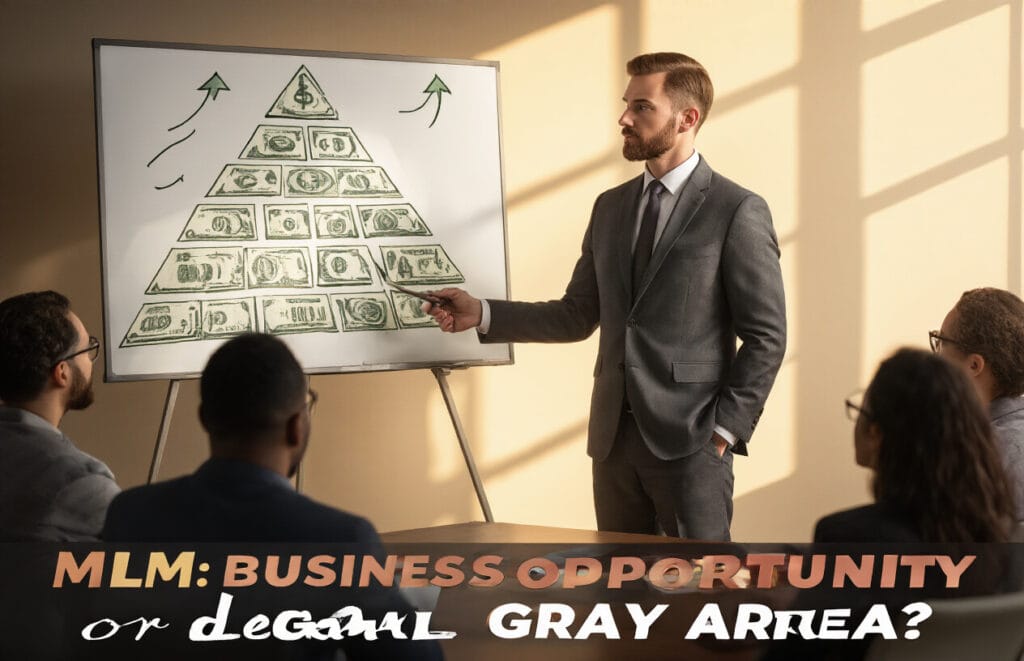

Wondering if that MLM opportunity your friend pitched is actually legal? You’re not alone. This guide cuts through the confusion for potential recruits, skeptics, and anyone curious about multilevel marketing’s legitimacy. We’ll explore what truly separates legal MLM companies from illegal pyramid schemes, reveal the warning signs of problematic business models, and break down the ongoing controversy that surrounds the industry. By the end, you’ll have the facts needed to protect yourself and make smarter decisions about MLM opportunities.

Defining Multilevel Marketing

How MLM Operates

MLM companies build networks where distributors make money two ways: selling products directly to customers and recruiting new distributors beneath them (their “downline”). As your downline grows, you earn commissions from their sales too. It’s like creating your own mini sales team.

The business typically starts with you buying inventory or a starter kit. Then you’re pushed to recruit friends and family to join your team. The pitch? “Be your own boss” and “unlimited income potential.” Sound familiar?

Most MLMs sell products ranging from weight loss supplements to essential oils to leggings – things people actually use. But here’s the catch: the real emphasis is often on recruiting rather than retailing.

Difference Between MLM and Traditional Business Models

Traditional Business vs. MLM

| Traditional Business | Multilevel Marketing |

|---|---|

| Fixed salary/hourly wage | Commission-based income |

| Clear employer-employee relationship | “Independent contractor” status |

| Company handles marketing | Distributors handle marketing |

| One-time sale commission | Ongoing commissions from downline |

| Fixed business location | Home-based/mobile business |

In traditional retail, the company pays for advertising and employees get steady paychecks. In MLMs, distributors shoulder all the risk – buying inventory upfront, marketing products themselves, and only earning when they make sales.

The biggest difference? In traditional business, your success doesn’t depend on recruiting others. In MLMs, the people at the top make the most because they have large downlines generating commissions for them.

Common Multilevel Marketing Compensation Structures

Most MLMs use one of these payment plans:

Binary Plan: Your downline splits into two legs (left and right). You earn when both sides generate sales, usually with balance requirements.

Unilevel Plan: Everyone you personally recruit forms your first level. Anyone they recruit becomes your second level, and so on. You earn different percentages from each level, typically up to 5-7 levels deep.

Matrix Plan: Restricts how many people you can have on each level (like a 3×3 matrix allows only 3 people on your first level). When the matrix fills, spillover occurs.

Breakaway Plan: Once your recruits reach certain sales levels, they “break away” from your group, but you still earn override commissions on their entire organization.

Popular Multilevel Marketing Companies in Today’s Market

Amway dominates the MLM world with annual sales exceeding $8.4 billion. Their catalog covers everything from home goods to nutrition products.

Herbalife focuses on weight management and nutritional supplements, weathering controversy while maintaining a global presence.

Avon, the beauty pioneer, has operated since 1886, making it one of the oldest MLMs still running.

Young Living and doTERRA compete fiercely in the essential oils space, both claiming superior product quality while building massive distributor networks.

Newer players like Color Street (nail strips) and Monat (hair care) have exploded on social media, with distributors flooding Instagram with before-and-after photos and recruiting pitches disguised as lifestyle content.

The Legal Status of Multilevel Marketing

A. Current laws governing Multilevel Marketing companies

Multilevel Marketing companies operate under a patchwork of federal and state laws in the US. At the federal level, the FTC Act serves as the primary legal framework, prohibiting “unfair or deceptive acts or practices.” No specific federal statute explicitly addresses MLMs, which is partly why this industry exists in a legal gray area.

Most states have adopted anti-pyramid scheme laws that MLMs must navigate. These laws typically focus on whether real products are being sold to real customers, not just to distributors padding their downlines.

The key legal requirements MLMs must meet include:

- Legitimate product or service with actual market value

- Compensation primarily from product sales, not recruitment

- Buy-back policies for unsold inventory

- Truthful earnings claims

The lack of uniform regulation creates challenges for both companies and potential distributors. It’s this regulatory patchwork that allows some questionable practices to persist.

B. Distinction between legal MLM and illegal pyramid schemes

The line between legitimate MLMs and illegal pyramid schemes isn’t always crystal clear. But there are telltale differences you should know about:

| Legal MLM | Illegal Pyramid Scheme |

|---|---|

| Focus on product sales to genuine customers | Focus on recruitment over actual sales |

| Products have real market value | Overpriced products with questionable value |

| Reasonable startup costs | High entry fees and inventory requirements |

| Income claims based on sales | Promises of passive, residual wealth |

| Transparent compensation plan | Complicated, confusing payment structures |

The “50% rule” is crucial here – legitimate MLMs typically require that at least 50% of revenue comes from sales to non-distributor customers. Without this external customer base, the math simply doesn’t work for distributors down the line.

Remember: if making money depends primarily on bringing in new people rather than selling products, you’re probably looking at a pyramid scheme.

C. FTC regulations and enforcement actions

The FTC has become increasingly aggressive in policing the MLM industry. They don’t just issue warnings – they shut companies down.

The agency focuses on several red flags:

- Unrealistic income claims (“Make $10,000 working part-time!”)

- Heavy inventory loading requirements

- Emphasis on recruitment over retail sales

- Lack of retail customers outside the network

Recent years have seen major enforcement actions with serious consequences. Herbalife paid $200 million in 2016 and completely restructured their business model after FTC intervention. AdvoCare abandoned their MLM structure entirely in 2019 following an FTC investigation.

The most damaging case was against Vemma, which the FTC effectively shut down after determining it was operating as a pyramid scheme targeting college students.

These actions send a clear message: the FTC is watching, and they’re not afraid to take action when companies cross the line.

D. International legal perspectives on MLM

MLM regulation varies dramatically worldwide, creating a complex global landscape for these companies.

Some countries embrace direct selling while maintaining strict oversight. Others have banned MLMs entirely or imposed such severe restrictions that they can’t effectively operate.

China represents perhaps the most interesting case. After banning direct selling completely in 1998, they later allowed MLMs to return under tight regulation – but with a strict ban on multi-level compensation. Companies must obtain special licenses, face regular audits, and navigate complex rules about how products can be sold.

The European Union generally permits MLMs but under strict consumer protection frameworks. Many EU countries mandate cooling-off periods, transparent earnings disclosures, and buy-back guarantees.

Several countries including Saudi Arabia, Nepal, and Rwanda have completely banned MLM structures, viewing them as inherently predatory.

This regulatory diversity creates challenges for international MLM companies, which must adapt their business models for each market they enter.

E. Recent legal cases involving MLM companies

The courts have been busy with MLM litigation in recent years, creating precedents that reshape the industry.

LuLaRoe faced multiple class-action lawsuits alleging they operated a pyramid scheme, ultimately settling for $4.75 million in 2021. The company changed several business practices as a result.

Neora (formerly Nerium) is locked in ongoing litigation with the FTC, which alleges the skincare MLM is an illegal pyramid scheme. This case could establish important precedent about what constitutes a legitimate MLM operation.

Perhaps most significant was the 2019 AdvoCare settlement. The energy drink company paid $150 million and completely abandoned their MLM model after FTC charges. This marked the first time a major MLM completely restructured rather than just paying fines.

Young Living and doTERRA have both faced legal challenges over product claims and business practices, resulting in significant settlements and business model adjustments.

These cases demonstrate that both government agencies and private plaintiffs are increasingly willing to challenge MLM practices in court – and winning significant victories that are reshaping the industry.

Red Flags and Warning Signs

Unsustainable business models

Ever noticed how some MLMs seem to defy basic math? That’s your first red flag.

When a company’s structure requires each person to recruit multiple others who must do the same, we’re looking at exponential growth that quickly becomes impossible. Do the math: if everyone needs to recruit just 5 people, by level 13, you’d need more than the entire US population.

These pyramid-shaped structures inevitably collapse because they run out of people. The folks at the bottom – which is about 99% of participants – end up with no one left to recruit and products they can’t sell.

Recruitment-focused compensation

Here’s the deal: if making money depends more on bringing people in than selling actual products, you’re probably looking at a sketchy setup.

Legitimate businesses focus on selling products to real customers. But in problematic MLMs, the big bucks come from:

- Recruiting fees

- Mandatory starter kits

- Required minimum purchases from your “downline”

When someone’s pushing harder for you to “join their team” than to try their amazing product, walk away.

Unrealistic income claims

“I make six figures working part-time from my phone!” Sound familiar?

Legitimate MLMs publish income disclosure statements. Check them. You’ll typically find:

- 90-99% of participants make little to no money

- Many lose money after expenses

- Only a tiny fraction at the top earn those flashy incomes

Any company promising quick riches, financial freedom, or showing off mansions and luxury cars is waving a massive red flag.

High-pressure sales tactics

Watch out for people using manipulation to get you to sign up:

- “This opportunity won’t last!”

- “Don’t you want financial freedom?”

- “What, are you afraid of success?”

They’ll use emotional appeals about supporting their business, guilt about saying no, or pressure to decide immediately. Some even target vulnerable groups like stay-at-home parents, military spouses, or those facing financial hardship.

Real opportunities don’t need high-pressure tactics. They stand on their own merits.

The Controversy Explained

A. High failure rates among participants

The dirty secret of MLMs? About 99% of participants lose money. Not a typo—99%.

While companies flash testimonials of top earners buying mansions and exotic cars, they’re showing you the lottery winners, not the average experience. Most distributors barely make enough to cover their mandatory product purchases.

Look at the income disclosure statements these companies are legally required to publish (though they often hide them in fine print). The numbers are brutal. At companies like Amway, Herbalife, and Mary Kay, the median annual income typically falls below $1,000 and that’s before expenses.

Why such abysmal stats? The business model itself. MLMs are structured as pyramids where only those at the very top profit significantly. The math simply doesn’t work for everyone else.

B. Market saturation issues

Ever had five different friends try to sell you the same essential oils? That’s saturation.

The MLM model encourages aggressive recruitment in limited markets. When a company enters a new area, early joiners might see some success. But soon, the market becomes flooded with competitors—often friends and family members selling identical products.

This creates a mathematical impossibility. If each person needs to recruit five others, by level 13 of recruitment, you’d need more people than exist on Earth. The reality? Most markets become saturated within months, leaving newcomers with no viable customer base.

C. Product quality and pricing concerns

MLM products typically cost 30-50% more than comparable retail items. Why? Because the price needs to support multiple levels of commissions.

Take that $45 protein shake powder. In a regular store, it might cost $20. The difference funds the upline—sometimes 5-7 levels of distributors all taking a cut.

Quality issues compound the problem. Many Multilevel Marketing products make exaggerated claims without scientific backing. Weight loss supplements, “miracle” skin creams, and “immune-boosting” essential oils often fail to deliver promised results, despite premium pricing.

Distributors rarely question these issues because they’re not just selling products—they’re selling their commitment to the company.

D. Social and relationship impacts

“Hey girl! Long time no see! Would love to catch up! ☕”

Sound familiar? That message from a high school acquaintance isn’t a genuine reconnection—it’s prospecting.

MLMs weaponize relationships. Distributors are trained to view friends and family as potential recruits or customers. This commercialization of personal relationships causes significant damage:

- Trust erosion when friends realize they’re being viewed as sales targets

- Family tensions when relatives feel pressured to support unsuccessful businesses

- Community fracturing when social gatherings become sales opportunities

- Social media fatigue as feeds become cluttered with product promotions

Many former distributors report losing friendships and straining family relationships permanently through their Multilevel Marketing involvement.

E. Psychological tactics used in recruitment

MLMs employ sophisticated psychological manipulation that borders on cultish:

- Love bombing: Showering prospects with attention, compliments and support

- False scarcity: “Only three spots left on my team!”

- Identity fusion: “You’re not just selling products, you’re a wellness advocate!”

- Thought-stopping techniques: Teaching distributors to dismiss skepticism as “negativity”

- Isolation: Encouraging members to distance themselves from “dream stealers”

Recruits are taught to attribute failure to personal shortcomings rather than the flawed business model. “You’re not working hard enough” becomes the explanation for inevitable financial losses.

The most insidious tactic? Hope exploitation. MLMs specifically target vulnerable populations—stay-at-home parents, military spouses, immigrants, and those facing financial hardship—by selling an illusion of financial freedom that statistics show is virtually unattainable.

Making Informed Decisions

Researching company track records

Want to avoid a costly mistake? Dig into a company’s history before signing on the dotted line.

Most MLMs leave a paper trail you can follow. Check if they’ve faced lawsuits, regulatory actions, or consumer complaints. The FTC website is gold for this info. So is the Better Business Bureau.

Look at how long they’ve been operating. Companies with decades of stable operation generally pose less risk than the new kid on the block promising overnight millions.

Social media can be eye-opening too. What are former distributors saying? Not the shiny happy posts from current reps, but the unfiltered experiences of people who’ve left.

Understanding the compensation plan

Those compensation plans? They’re deliberately complicated for a reason.

Ask these questions point-blank:

- How much comes from recruiting versus actual product sales?

- What percentage of people make it to each level?

- Are there ongoing purchase requirements to stay “active”?

If the answers are vague or the person gets defensive, that’s your red flag right there.

Calculating realistic income potential

The numbers don’t lie, but income disclosures sure can bend the truth.

Most MLMs publish income disclosure statements. Read the footnotes – that’s where the real story hides. When they say “average income,” check if they’re including everyone or just “active” distributors.

Do the math yourself:

- How many products would you need to sell monthly?

- How many hours would that take?

- What’s your hourly rate after expenses?

I’ve seen people shocked to discover they’re working for pennies an hour.

Evaluating product value independently

Strip away the marketing hype and ask: Would you buy this product at this price if no business opportunity was attached?

Compare similar products from regular retailers. If the Multilevel Marketing version costs 3-5 times more, you’re probably paying for that compensation plan, not superior quality.

Try this test: Ask potential customers if they’d buy the product without hearing about the business opportunity first. Their honest reaction tells you everything.

The legality of multilevel marketing exists in a gray area, where legitimate Multilevel Marketing companies operate lawfully while pyramid schemes masquerade as Multilevel Marketing businesses. Understanding the key differences

focus on product sales versus recruitment, realistic income claims, and sustainable business models is crucial for anyone considering joining such opportunities. Regulatory bodies like the FTC continue to monitor these companies closely, but the responsibility ultimately falls on individuals to recognize warning signs.

Before joining any Multilevel Marketing company, conduct thorough research on its business model, income disclosure statements, and reputation. Speak with current and former distributors, calculate potential costs and profits realistically, and consult with financial advisors if necessary. While some people find success in multilevel marketing, approaching these opportunities with informed skepticism and realistic expectations provides the best protection against potential financial and personal disappointment.